Incentivizing Local Businesses to Adopt Renewable Energy Sources

Overview

The industrial sector accounts for around 23% of the EU’s total GHG emissions, while the tertiary sector contributes about 15% (EEA). These figures highlight the importance of addressing emissions from these sectors to meet the EU's climate targets.

Spanish Municipalities manage the Economic Activities Tax, a levy imposed on businesses and professionals for engaging in any economic activities. It is typically calculated based on various factors such as location, size, and type of activity. Furthermore, Spanish Municipalities manage the Environmental License Fee, a charge for businesses needing environmental licenses to operate.

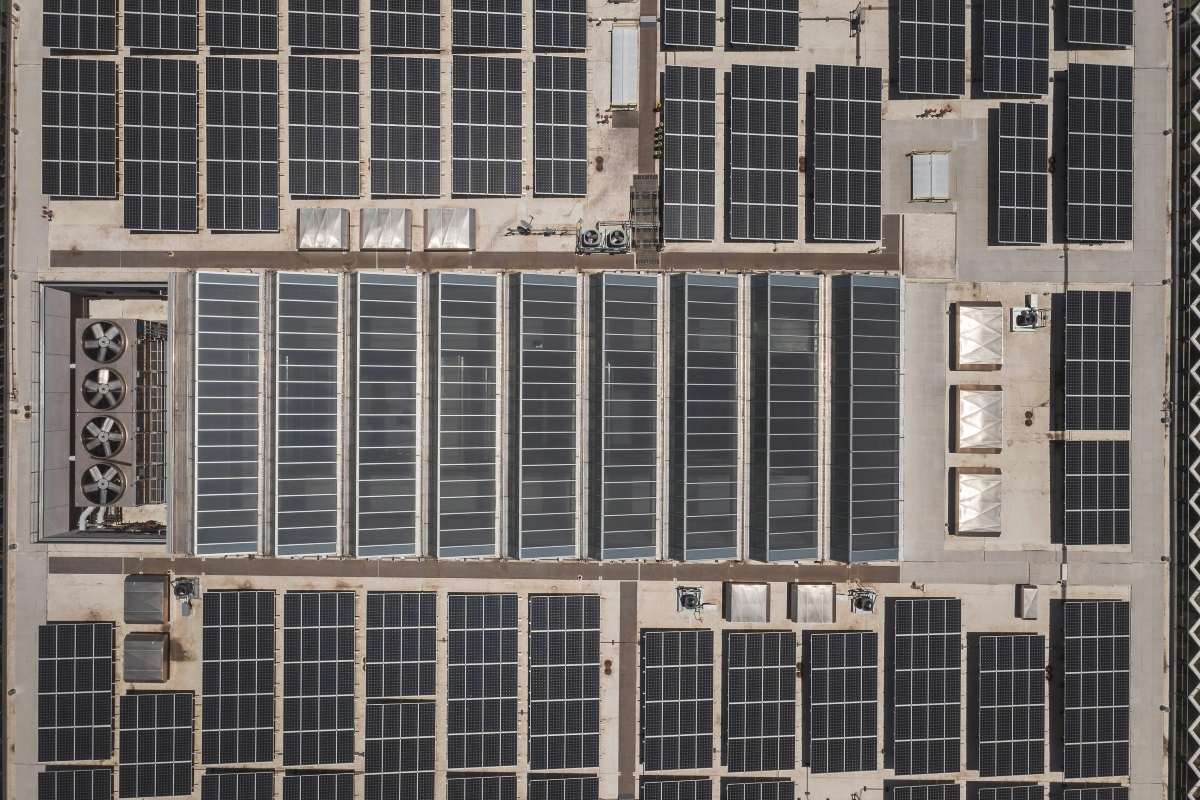

With the support of the LOCAL4GREEN (Interreg MED 2014-20) project, a reduction of the Environmental License Fees and the Economic Activities Tax from 5% to 50% have been granted by Spanish municipalities to businesses that installed renewable energy sources, contributing to decrease the greenhouse gases emissions of the industry and tertiary sectors.

Evidence of success

In the Quart de Poblet (ES), an estimate has been made that 1% of companies will benefit from the economic activity tax incentive with an average installed capacity of 10 kW for each of the companies (213,744 kWh from renewable energies and 82,291 kg of CO2 eq avoided each year).

Location

Altea (ES); Quart de Poblet (ES); Pedreguer (ES); Denia (ES); Burjassot (ES); Rafelguaraf (ES)

Timescale

2018-ongoing

Potential of learning or transfer

The Municipality of Altea's reduction in the "Urban Destination Certificate" cost for renewable energy projects sets a crucial precedent. This move highlights the potential to adjust other municipal taxes, factoring in the additional costs of climate change mitigation. Such adjustments could be vital, especially for municipalities bound by climate commitments like the Covenant of Mayors.

Contacts

For the Spanish municipalities:

Yolanda Nicolau: ynicolau@fvmp.org

Francesco Filippi: Francesco.proyectos@musol.org

Read more ...

- Full description of the municipal fiscal system and analysis of feasibility of the green fiscal model in Bosnia and Herzegovina

- Municipal bylaw regulating the fee for urbanistic certification to promote renewable energy sources in the municipality of Altea (ES) (in local language)

- Municipal bylaw regulating the economic activity tax incentives to promote renewable energy sources in the municipality of Burjassot (ES) (in local language)

- Municipal bylaw regulating the economic activity tax incentives to promote renewable energy sources in the municipality of Denia (ES) (in local language)

- Municipal bylaw regulating the economic activity tax incentives to promote renewable energy sources in the municipality of Pedreguer (ES) (in local language)

- Municipal bylaw regulating the economic activity tax incentives to promote renewable energy sources in the municipality of Quart de Poblet (ES) (in local language)

- Municipal bylaw regulating the economic activity tax incentives to promote renewable energy sources in the municipality of Rafelguaraf (ES) (in local language)